CHAPTER 7 Value-at-Risk Contribution. INTRODUCTION The output from a VaR calculation includes the following reports that can be used to identify the magnitude. - ppt download

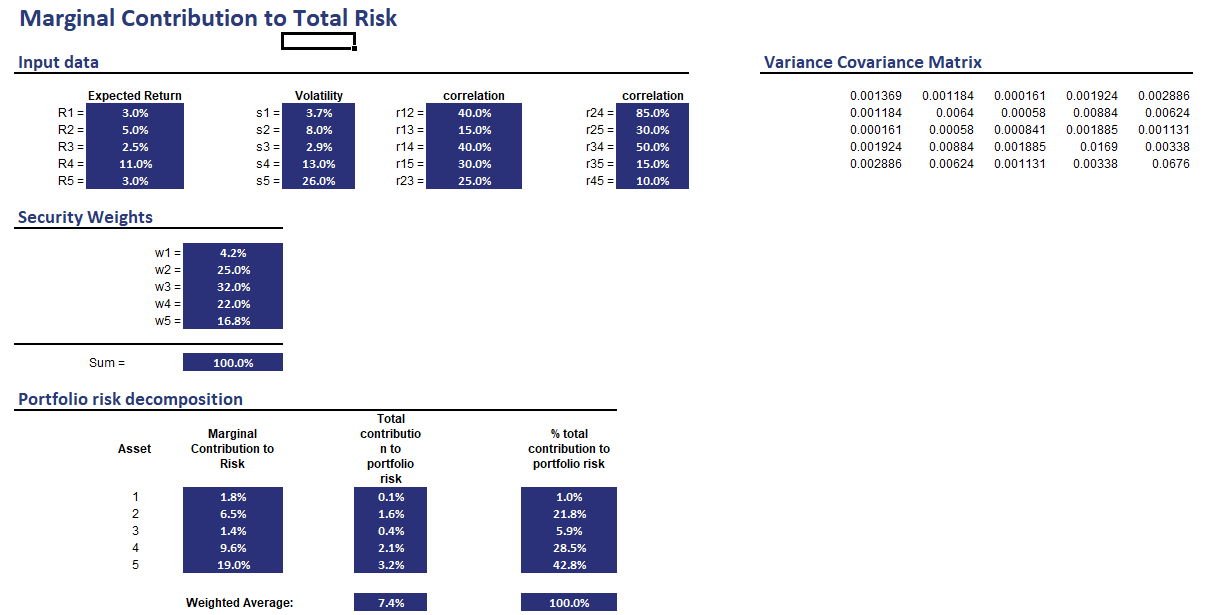

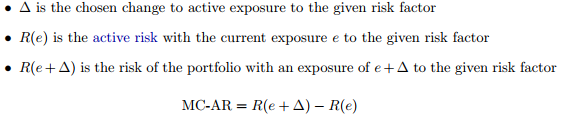

CFA Level 3 : Principles of Asset Allocation - Risk Budgeting - Marginal Contribution to Risk Part 1 - YouTube

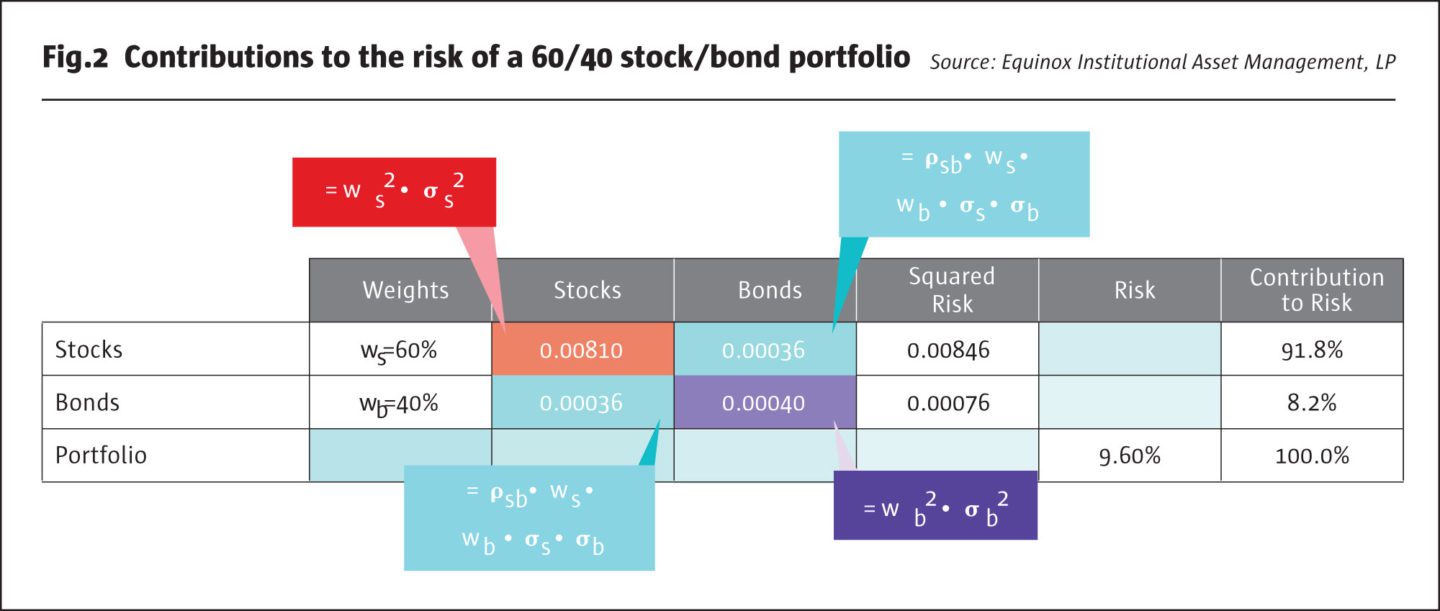

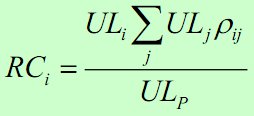

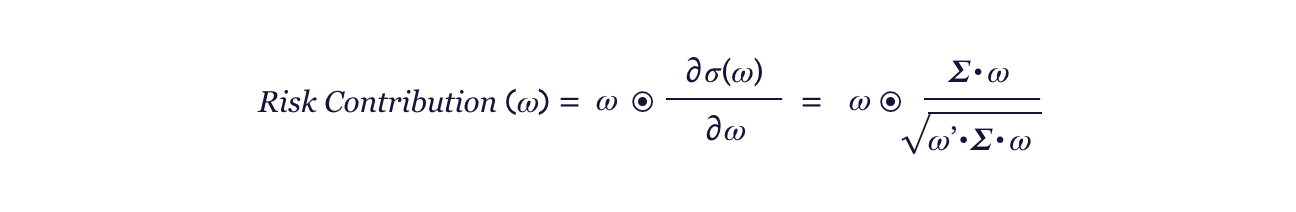

Business — Banking — Management — Marketing & Sales » Risk Management in Banking » ABSOLUTE AND MARGINAL RISK CONTRIBUTIONS TO PORTFOLIO LOSS VOLATILITY AND CAPITAL

![PDF] Risk Contribution Is Exposure Times Volatility Times Correlation: Decomposing Risk Using the X-Sigma-Rho Formula | Semantic Scholar PDF] Risk Contribution Is Exposure Times Volatility Times Correlation: Decomposing Risk Using the X-Sigma-Rho Formula | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/71ef3efc5dcbe190232d6d86615e5188e3eef49d/14-Table1-1.png)

PDF] Risk Contribution Is Exposure Times Volatility Times Correlation: Decomposing Risk Using the X-Sigma-Rho Formula | Semantic Scholar